The greater Phoenix metro area (primarily Maricopa County) experienced a stable but buyer-friendly shift in its residential real estate market in 2025, characterized by modest price growth, increased inventory, and longer days on market. This was influenced by lingering higher interest rates early in the year, followed by gradual easing, leading to more balanced conditions compared to the seller-dominated markets of prior years. Sales volume rose slightly, but the market outpaced national trends in key areas like new listings and pending sales. Data is drawn from multiple sources, including year-end reports and YTD analyses through October or November 2025, with full-year extrapolations where noted. Key highlights for 2025:

Total Home Sales: Approximately 62,400 (extrapolated from ~52,000 closed sales in the first 10 months for single-family homes; average monthly sales around 5,686).

Other Data Points:

Average days on market: 74 (up from 64 in 2024, indicating slower sales pace).

Inventory: 4.4 months of supply (a healthy balance, up 19.2% from 2024, giving buyers more choice).

New listings: Up 8% YTD compared to 2024.

Pending sales: Up 0.5% YTD compared to 2024.

Affordability: Improved slightly, with 71% of households able to afford the median home (up 2.9% from 2024).

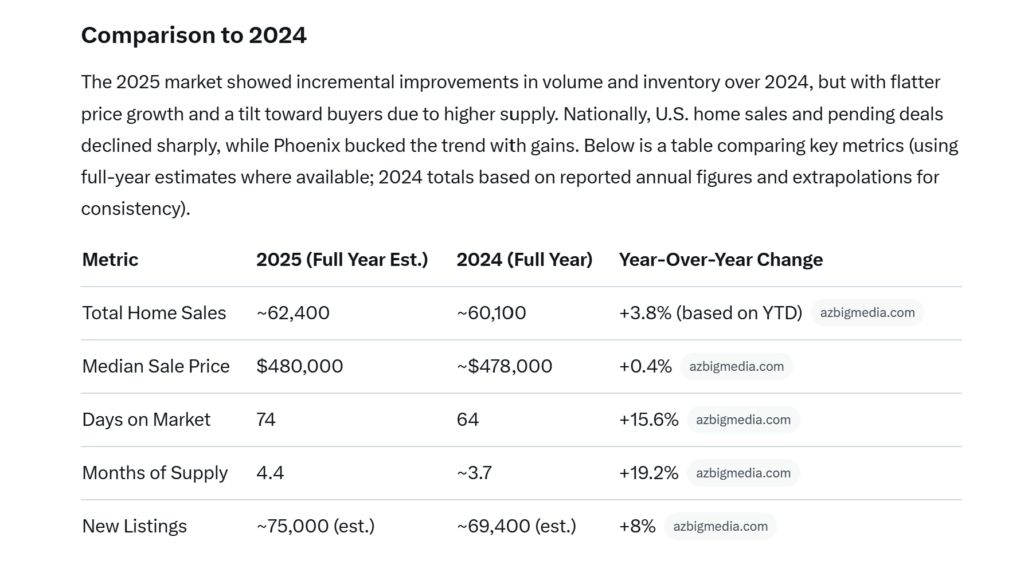

Comparison to 2024

The 2025 market showed incremental improvements in volume and inventory over 2024, but with flatter price growth and a tilt toward buyers due to higher supply. Nationally, U.S. home sales and pending deals declined sharply, while Phoenix bucked the trend with gains. Below is a table comparing key metrics (using full-year estimates where available; 2024 totals based on reported annual figures and extrapolations for consistency).

Notes on data:

Sales figures focus on single-family homes but align with broader residential trends; total residential (including condos/townhomes) may be 10-15% higher.

Prices varied by submarket—luxury segments (> $1M) propped up averages, while entry-level homes ($250K-$400K) saw more activity and slight price drops.

azcentral.com

2025’s modest growth reflects a cooling from peak 2022 levels (when prices surged >50% post-COVID), but Phoenix remained more resilient than national averages amid national economic uncertainty.

Leave A Comment

You must be logged in to post a comment.